Defining corporate compliance in the entrepreneurial context

Compliance as a Strategic Foundation in Startups

In the entrepreneurial landscape, corporate compliance is more than a checklist or a legal formality. It is a strategic approach that helps a company navigate risk, protect data, and build a resilient business. For general managers, understanding compliance means recognizing its role in shaping the organization’s ethical culture and governance from the outset.

Compliance programs in startups and growing businesses are designed to ensure that all employees, from management to frontline staff, follow established policies and procedures. These programs are not just about avoiding penalties—they foster trust with customers, investors, and third parties. A robust compliance program integrates risk management, data privacy, and internal controls into daily operations, making compliance a living part of the corporate culture.

- Risk assessment helps identify potential risk areas before they become issues.

- Policies and procedures set clear expectations for conduct and decision-making.

- Training and communication ensure employees understand their responsibilities and the importance of ethics compliance.

- Monitoring and controls allow for ongoing evaluation and improvement of compliance programs.

For entrepreneurial ventures, compliance officers or designated management play a crucial role in guiding the company through evolving regulations and ethical challenges. The effectiveness of a compliance program depends on leadership’s commitment to ethical conduct and transparent governance. This commitment is essential for building an ethical culture that supports sustainable growth and innovation.

As the business environment rapidly changes, general managers must ensure their compliance strategy remains agile and responsive. For insights on adapting compliance programs to fast-moving markets, explore this resource on agile compliance strategies for startups.

Why compliance matters for entrepreneurial ventures

The Strategic Value of Compliance for Entrepreneurs

For entrepreneurial ventures, compliance is more than just a legal obligation. It is a strategic asset that helps protect the company from risk and builds a foundation for sustainable growth. By embedding robust compliance programs early, startups and growing businesses can avoid costly pitfalls and foster trust with stakeholders, investors, and customers.

Safeguarding the Business from Risk

Entrepreneurs operate in fast-moving environments where regulatory requirements can shift quickly. A strong compliance program helps identify and manage risk areas, from data privacy to third party relationships. Effective compliance policies and internal controls reduce the likelihood of regulatory breaches, fines, or reputational damage. This is especially important for companies handling sensitive data or operating across borders, where compliance ethics and governance standards may vary.

- Protects the organization from legal and financial penalties

- Ensures ethical conduct and adherence to the code of conduct

- Supports risk management and ongoing risk assessment

Building Trust and Credibility

Corporate compliance programs signal to employees, partners, and customers that the business values ethical behavior and responsible management. This commitment to compliance and ethics helps attract investment, retain talent, and open doors to new markets. When employees receive regular training on policies and procedures, they are empowered to act in line with the company’s values and compliance policies.

Enabling Agility in a Changing Landscape

Startups and entrepreneurial ventures often face rapid change. An agile compliance strategy allows the business to adapt quickly while maintaining strong controls. For insights on how to keep your compliance program responsive, explore navigating the whirlwind of change in compliance strategy.

Ultimately, prioritizing compliance is not just about avoiding penalties. It is about building a resilient, ethical culture that supports long-term business success. As we explore the key elements of effective compliance programs, it becomes clear how essential these foundations are for entrepreneurial growth.

Key elements of effective compliance programs

Core Components Every Compliance Program Needs

For a company aiming to build a robust compliance program, it’s essential to understand the foundational elements that drive effectiveness. These components help organizations manage risk, foster ethical conduct, and ensure long-term business sustainability. Let’s break down the key elements that general managers should prioritize:

- Clear Policies and Procedures: Every organization needs well-documented compliance policies and procedures. These should cover risk areas relevant to the business, such as data privacy, anti-corruption, and third party relationships. Policies must be accessible and regularly updated to reflect regulatory changes and evolving business needs.

- Code of Conduct: A code of conduct is the backbone of corporate culture. It sets expectations for ethical behavior and guides employees in making the right decisions. A strong code of conduct reinforces the company’s commitment to ethics and compliance.

- Ongoing Training and Communication: Effective compliance programs invest in regular training for employees at all levels. Training should be practical, engaging, and tailored to the specific risks the organization faces. Open communication channels allow employees to ask questions and report concerns without fear of retaliation.

- Risk Assessment and Management: Identifying and evaluating risk areas is critical. Regular risk assessments help management allocate resources efficiently and adapt controls to new threats. This proactive approach to risk management supports business growth and resilience.

- Internal Controls and Monitoring: Strong internal controls are necessary to detect and prevent misconduct. Compliance officers should implement monitoring systems to track compliance with policies and flag potential issues early. These controls also support data privacy and governance requirements.

- Reporting Mechanisms and Investigations: Employees must have safe, confidential ways to report suspected violations. Prompt, thorough investigations demonstrate the organization’s commitment to compliance ethics and reinforce trust in the program.

- Leadership and Accountability: Senior management and compliance officers must lead by example. Their visible commitment to compliance and ethical culture sets the tone for the entire organization. Accountability at all levels ensures that policies are not just words on paper but are integrated into daily business operations.

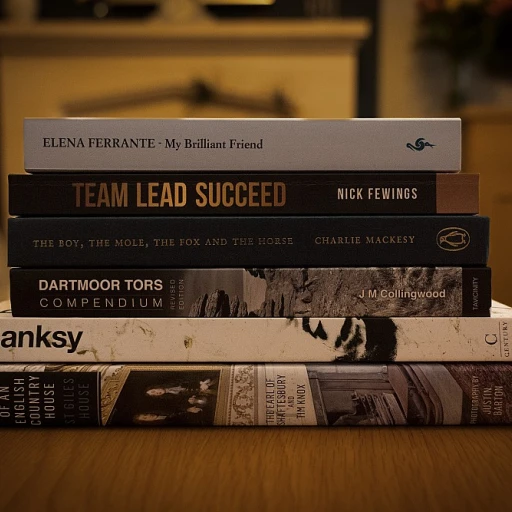

When these elements are in place, a compliance program becomes more than a box-ticking exercise. It transforms into a strategic asset that supports business objectives, strengthens corporate governance, and builds a resilient organization. For more on how effective strategies can boost team performance and reinforce compliance, explore this insightful resource.

Challenges general managers face in implementing compliance

Common Obstacles in Compliance Implementation

For general managers in entrepreneurial companies, putting a robust compliance program into practice is rarely straightforward. The fast pace and resource constraints typical of startups can make it tough to prioritize compliance policies and procedures. Here are some of the main challenges faced:

- Resource Limitations: Many startups operate with lean teams and tight budgets. Allocating time and money to develop effective compliance programs, training, and internal controls can feel like a stretch when immediate business growth is the focus.

- Rapid Change: Entrepreneurial organizations often pivot quickly, which can outpace the ability of compliance officers to update policies, procedures, and risk assessments. This agility, while a business strength, can expose the company to new risk areas if compliance does not keep up.

- Lack of Awareness: Employees and even management may not fully understand the importance of compliance, ethics, and governance. Without ongoing training and clear communication, a culture of compliance and ethical conduct can be hard to establish.

- Complex Regulatory Environment: Navigating multiple regulations—especially around data privacy, third-party relationships, and ethical standards—can be overwhelming. General managers must ensure the company’s compliance program addresses all relevant laws and industry standards.

- Integration with Business Strategy: Sometimes, compliance is seen as a box-ticking exercise rather than a strategic asset. This mindset can prevent the organization from embedding compliance ethics and risk management into its core business processes.

Overcoming Barriers to Foster Ethical Culture

Despite these hurdles, effective compliance programs are achievable. It starts with leadership commitment to ethics and a clear code of conduct. General managers should work to:

- Embed compliance policies into daily operations and decision-making

- Invest in regular training for employees at all levels

- Conduct ongoing risk assessments to identify and address emerging risk areas

- Appoint a dedicated compliance officer or team, even if part-time, to oversee programs and internal controls

By addressing these challenges head-on, entrepreneurial organizations can build a strong foundation for ethical business practices and long-term growth. A proactive approach to compliance not only reduces risk but also strengthens the company’s reputation and trust with stakeholders.

Building a culture of compliance in startups

Embedding Compliance into Everyday Actions

Creating a robust compliance culture in startups is not just about having policies and procedures on paper. It is about integrating ethics, risk management, and corporate governance into the daily operations of the company. This means that compliance programs should be visible in every aspect of the business, from onboarding new employees to managing third party relationships.- Clear Code of Conduct: A well-communicated code of conduct sets expectations for ethical behavior and helps employees understand the boundaries of acceptable actions within the organization.

- Accessible Policies and Procedures: Compliance policies should be easy to find and written in clear language. Employees need to know where to access guidance on data privacy, internal controls, and risk areas relevant to their roles.

- Ongoing Training: Regular training sessions reinforce the importance of compliance and keep employees updated on changes in laws, regulations, and internal policies. This also helps in identifying potential risk areas before they escalate.

- Leadership Commitment: When management and compliance officers demonstrate a commitment to ethics and compliance, it sets the tone for the rest of the organization. Leadership should actively participate in compliance programs and communicate their importance.

- Open Communication Channels: Employees should feel comfortable reporting concerns or violations without fear of retaliation. Establishing confidential reporting mechanisms supports a transparent and ethical culture.

Aligning Compliance with Startup Agility

Startups often move quickly, but this agility should not come at the expense of effective compliance. Embedding compliance ethics into the corporate culture means making it part of the company’s identity, not just a checklist. This includes integrating risk assessment and management into strategic decisions, ensuring that compliance officers are involved in key business discussions, and regularly reviewing the effectiveness of compliance programs. A strong ethical culture also supports better decision-making and risk controls, which are essential for long-term business growth. By making compliance a shared responsibility, startups can build trust with stakeholders, protect sensitive data, and navigate complex regulatory environments more effectively.Measuring the impact of compliance on business growth

Evaluating Compliance Program Outcomes

Measuring the impact of a compliance program on business growth is not just about ticking boxes. It is about understanding how robust compliance policies and ethical culture drive real value for the company. General managers need to look beyond regulatory requirements and focus on how compliance programs support risk management, strengthen internal controls, and foster trust among employees and stakeholders.Key Metrics to Track

- Reduction in Risk Areas: Monitor incidents related to data privacy, code of conduct breaches, and third-party risks. Fewer incidents often signal effective compliance and risk assessment.

- Employee Engagement: Track participation in compliance training and feedback on ethics compliance. High engagement reflects a strong corporate culture and awareness of policies procedures.

- Audit and Investigation Results: Analyze findings from internal audits and investigations. Fewer policy violations and improved controls indicate a maturing compliance program.

- Regulatory Outcomes: Fewer fines or regulatory interventions show that the organization’s governance and compliance officers are proactive and effective.

- Business Performance: Assess whether ethical conduct and compliance ethics correlate with improved customer trust, better partnerships, and overall business growth.